If you’ve ever had an employee lose their home to foreclosure, if you’ve ever had an employee lose everything in a fire, if you’ve ever had an employee deal with the costs of catastrophic medical bills, then you know that personal financial pressures are not good for your workplace. The personal financial pressures beating down on one employee impact the whole workgroup. Everyone’s productivity drops. And how an employer responds (or doesn’t respond) tells a lot about the values of the organization.

There are the “social” responses: let’s raise money so Sue can pay for her husband’s medical bills not covered by our health insurance; let’s donate clothes and furniture for Bob and his family whose house burned down; or, does anyone know of a house that Beth and Mary Ellen can rent till they get on their feet?

On the surface, these are all caring and supportive organizational responses that are frequently organized by the HR Department. But let’s step back for a minute.

What if Sue and her husband had attended financial planning seminars that had delved into how to be prepared for unexpected medical costs? What if Bob had spent time one-on-one with a financial planner every year and had an emergency fund ready to go when his family lost its house? What if Beth and Mary Ellen together had spent time with an investment advisor and as a result never bought the house they gave back to the bank because they couldn’t afford it?

Financial wellness – an emerging recognition that health is about more than the physical body – is becoming more than a topic of conversation. It’s becoming a subcategory of services and benefits that employers are deploying within their total rewards packages. It used to be that only the C-Suite got financial planning support as part of their compensation. But more and more employers are recognizing that personal financial stress can be as negative in relation to employee productivity and engagement as other types of stress. And they are stepping up by providing access to apps like HelloWallet, as well as services like annual financial planning seminars and access to financial counselors all year long.

In a recent white paper, Financial Wellness, The Future of Work, Matt Fellowes and Jake Spiegel give an overview of the rise of financial wellness as an employer concern and describe the historical macro-economic context within which employers are paying attention to the financial health of their employees. It’s an interesting read and some of the data involve huge sums of money. It does an excellent job of connecting the macro (the economic trends) with the micro (your individual employees).

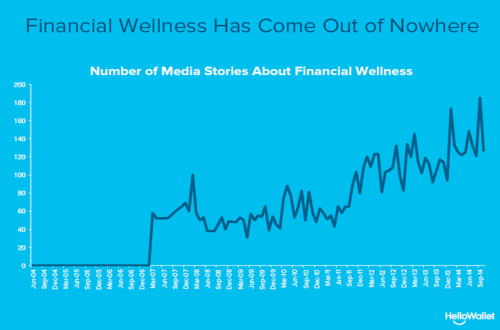

It’s interesting to note the birth of the Financial Wellness category as shown in the chart below:

Born in the Great Depression (2007-2009), the steady rise of interest in this category can be understood as chronicled through media attention.

Many employers are looking for cost effective solutions that will help their employees avert personal financial disaster. Many old school benefits providers are adding programs and a great many start-ups are tackling this need as well.

Helping Sue, Bob, Beth and Mary Ellen – and their colleagues – before personal financial disaster strikes may not be just a “nice to have” in today’s complex economic environment. It might be one of the benefits features that makes your organization more attractive to prospective employees and that makes your organization more sticky for existing employees.

Join me tomorrow at 11:00amPDT/2:00pmEDT for a webinar in which we’ll take a look at the cultural values that make this kind of benefit make sense. You may register here: http://info.hellowallet.com/2015.08Webinar.ChinaGorman.html.